Volatility as a Weapon: How to Profit from Crypto Swings with Binary Options

There is high volatility in the crypto market since the price fluctuates in the shortest time possible. This shows how much value could alter within a few minutes, thus the risks and opportunities. But conversely, for those traders who possess the ability to handle such risks, the volatility of crypto assets, far from being a source of fear, is a strength. However, if you can find ways to trade on these high and low prices by using the binary options trading system, then you can earn a lot even in a volatile market.

Ups and Downs in Crypto Markets

Crypto market high/low volatility implies massive fast changes in the value of crypto assets such as BTC, ETH, and other altcoins. Different from stocks and bonds, cryptos are very decentralized and therefore they don't come with many rules or a home base, which means their prices are very volatile and can increase or decrease for multiple and sometimes unpredictable factors.

These reasons might be how people have attitudes towards the market, some news, making new rules and regulations, technological advancements or even seeing prominent figures post on social media platforms.

Factors Influencing Crypto Volatility

- Market Sentiment: The crypto market differs from traditional markets. Regular people, not big institutions, drive it. This makes crypto prices change fast when people's feelings about them change.

- Regulatory News: What governments say or do about crypto has a big impact on prices. If a country bans crypto trading, prices might drop. If a country welcomes it, prices could go up.

- Technological Developments: Changes in blockchain tech can affect crypto prices. People might pay more for a crypto if they expect a good update. But if the tech has problems, the price might go down.

- External Influences: Non-financial events, like political unrest or a worldwide health crisis, can also affect crypto prices. This adds to the overall price swings in the market.

Binary Options: A Way to Make Money from Market Swings

Binary options give traders a chance to guess if an asset's price will go up or down within a set time. Unlike regular trading where your profit or loss depends on how much the price moves binary options pay out a fixed amount if you guess right. This makes them appealing to traders who want to profit from quick price changes in markets that move a lot, like crypto.

How Binary Options Work

When you trade binary options, you're basically betting on one of two things: that an asset's price will be higher or lower than a certain point at a specific time. Here's a simple breakdown:

- Call Option: You think the asset's price will go up from where it is now.

- Put Option: You think the price will drop from its current level.

If you guess right when the option expires, you get a set amount of money. If you're wrong, you lose what you put in.

Why Binary Options Work Well in Shaky Markets

- Controlled Risk: Binary options give you a clear picture of risk and reward. You'll know what you can win or lose before you start trading. This can help when markets are unstable.

- Short-Term Opportunities: Crypto markets can change a lot in just minutes or seconds. Binary options let you make money from these quick changes. You can even trade options that last 60 seconds.

- Simplicity: Binary options are easy to get. You don't need to worry about hard market studies or fancy trading plans. You just guess which way the price will go.

Profitable Strategies to Trade Crypto Binary Options

To use binary options well in fast-changing crypto markets, you need a clear plan. Here are some common plans traders often use:

1. The Trend Following Plan

This plan focuses on spotting the main direction of the market and making trades that match it. In quick-changing markets, trends can pop up fast, and this plan tries to make the most of these trends. You can learn in this course about binary options trading, including trading with crypto, where tools like moving averages or trendlines can help figure out which way the market is going.

2. The Breakout Plan

A breakout happens when a cryptocurrency's price moves beyond a set support or resistance level. The breakout strategy involves making trades in the breakout's direction expecting the price to keep moving that way. This strategy works well in shaky markets where prices tend to break out of set ranges.

3. The News-Based Strategy

News influences crypto prices so this approach involves keeping an eye on news sources and making trades based on upcoming reports or happenings. Let's say a government introduces new regulations or a major tech update is set to roll out, traders can set up binary options depending on how they believe the market will respond.

4. The Reversal Strategy

Markets with high volatility often experience dramatic price shifts followed by adjustments or turnarounds. The turnaround approach aims to spot when an overextended or undervalued situation might flip giving you a chance to make a trade that benefits from the price fixing itself.

5. The 60-Second Approach

If you want to gain from very brief periods of instability, the 60-second approach can work well. This involves making trades that end in 60 seconds, letting you conduct many trades quickly profiting from swift price changes.

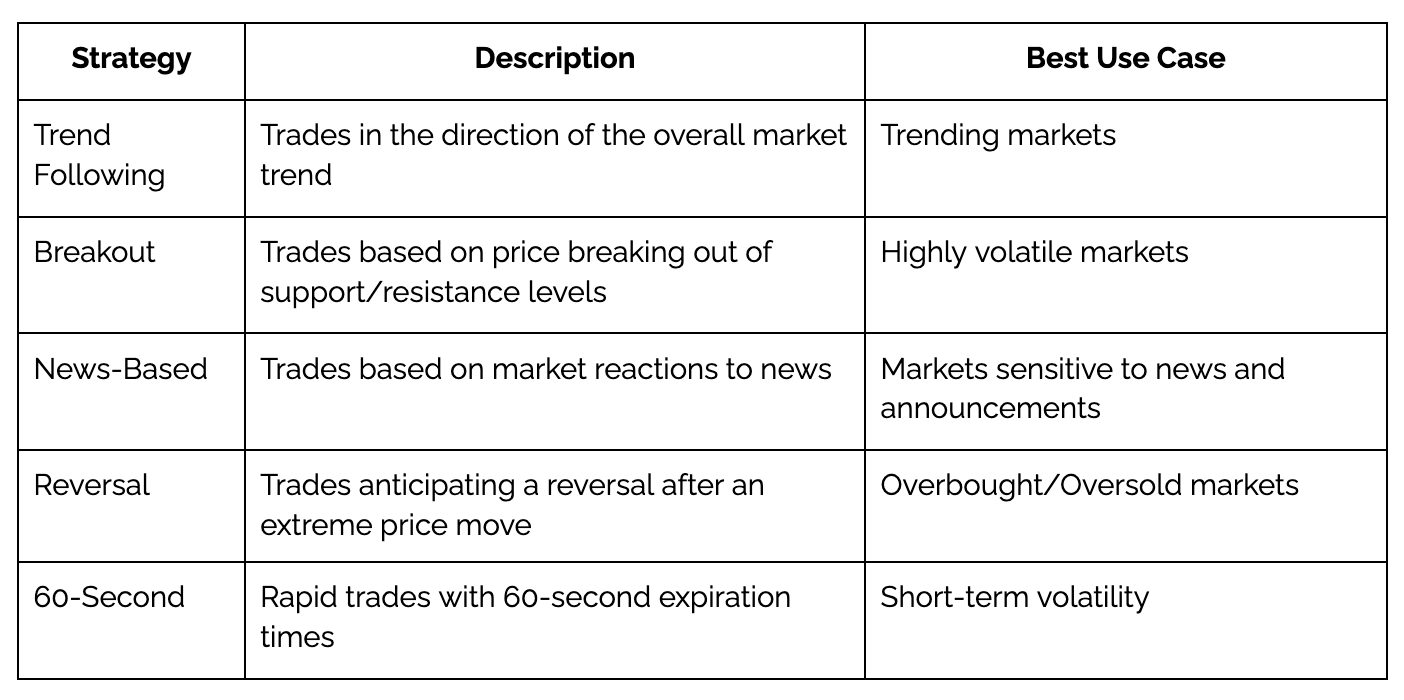

Strategies and Their Best Use Cases

To provide a clearer understanding of how to apply these strategies, here's a table summarizing each strategy along with its best use case:

To Wrap Up

The ups and downs of the crypto market can scare people, but if you know what you're doing and have the right tools, you can make good money from it. Binary options give you a special way to use these big price swings. They let you profit even when prices move a little bit. If you get to know the market well pick the right plan, and keep your risks in check, you can use crypto's crazy moves to your benefit. Just keep in mind that while you might make a lot of money, you could also lose a lot - so always trade smart and stay up to date on what is happening.